Embark on a journey through the realm of ERP finance, where businesses find efficiency and innovation in managing their financial processes. From streamlining operations to enhancing decision-making, ERP finance systems play a crucial role in today’s digital landscape.

Delve deeper into the intricacies of ERP finance and discover how this technology reshapes the financial landscape of organizations worldwide.

Introduction to ERP Finance

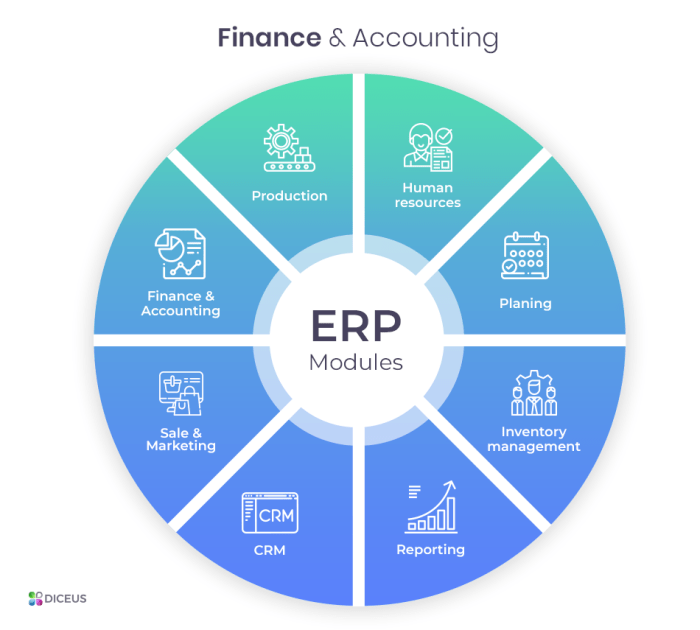

ERP Finance, or Enterprise Resource Planning Finance, is a software application that helps organizations manage and integrate their financial processes. It plays a crucial role in streamlining financial operations, providing real-time insights, and improving overall efficiency.

Significance of ERP Finance in Business Operations

- ERP Finance systems centralize financial data, making it easier to access and analyze information across departments.

- These systems automate repetitive tasks like accounting, invoicing, and reporting, reducing the risk of errors and saving time.

- ERP Finance software enhances financial transparency and compliance with regulatory requirements, ensuring accurate financial reporting.

Popular ERP Finance Software

- SAP S/4HANA: A comprehensive ERP solution that integrates finance, supply chain, sales, and more.

- Oracle NetSuite: Cloud-based ERP software that offers financial management, CRM, and e-commerce capabilities.

- Microsoft Dynamics 365 Finance: An ERP system that provides financial planning, budgeting, and analytics tools.

Features and Capabilities

ERP Finance systems offer a wide range of features and capabilities that streamline financial management processes for organizations. These systems are designed to enhance efficiency, accuracy, and transparency in handling financial data and operations.

Key Features of ERP Finance Systems

ERP Finance systems come equipped with essential features such as general ledger, accounts payable/receivable, asset management, cash management, and financial consolidation. These features allow businesses to track, manage, and report on their financial activities in a centralized and integrated manner.

Financial Reporting and Analysis

ERP Finance systems play a crucial role in financial reporting and analysis by generating detailed reports, financial statements, and performance metrics. These systems provide real-time insights into financial data, enabling stakeholders to make informed decisions based on accurate and up-to-date information.

Managing Budgeting and Forecasting

One of the key capabilities of ERP Finance systems is their ability to facilitate budgeting and forecasting processes. These systems allow organizations to create, monitor, and analyze budgets, as well as forecast future financial performance based on historical data and projections.

By leveraging advanced forecasting tools and budgeting modules, ERP Finance systems help businesses optimize their financial planning and decision-making.

Implementation and Integration

When implementing an ERP Finance system, organizations go through several key steps to ensure a successful integration. These steps involve careful planning, customization, testing, and training to ensure that the system meets the organization’s specific needs.

Steps in Implementing an ERP Finance System

- Planning: Define the goals and objectives of the ERP Finance implementation, identify key stakeholders, and create a project plan.

- Customization: Tailor the ERP Finance system to suit the organization’s unique requirements and processes.

- Testing: Conduct thorough testing to ensure that the system functions correctly and meets the organization’s needs.

- Training: Provide comprehensive training to employees to ensure they can effectively use the ERP Finance system.

- Go-Live: Launch the ERP Finance system and monitor its performance to address any issues that may arise.

Challenges Organizations Face During ERP Finance Integration

- Data Migration: Transferring data from legacy systems to the new ERP Finance system can be complex and time-consuming.

- Resistance to Change: Employees may be resistant to adopting new processes and technologies, impacting the success of the integration.

- Cost: Implementing an ERP Finance system can be costly, and organizations need to carefully manage their budgets.

- Integration with Existing Systems: Ensuring seamless integration with other business systems can be challenging and require additional resources.

Benefits of Integrating ERP Finance with Other Business Systems

- Improved Efficiency: Integrating ERP Finance with other systems streamlines processes and eliminates duplication of work.

- Enhanced Data Accuracy: By integrating systems, organizations can ensure that data is consistent and up-to-date across all platforms.

- Better Decision-Making: Access to real-time data from integrated systems enables organizations to make informed decisions quickly.

- Increased Visibility: Integration provides a holistic view of the organization’s financial data, enabling better reporting and analysis.

Security and Compliance

Data security is of utmost importance in ERP Finance systems as they deal with sensitive financial information that must be protected from unauthorized access or breaches. Ensuring the security of data is crucial to maintaining the integrity and trustworthiness of the financial processes within an organization.

Importance of Data Security

ERP Finance systems employ various security measures such as encryption, user authentication, and role-based access control to safeguard financial data. These systems also regularly undergo security audits and updates to stay ahead of potential threats and vulnerabilities.

Compliance with Financial Regulations

ERP Finance systems play a key role in ensuring compliance with financial regulations by providing tools and features that help organizations adhere to industry standards and legal requirements. These systems help in tracking and reporting financial transactions accurately, thereby aiding in regulatory compliance.

Role of ERP Finance in Safeguarding Sensitive Information

ERP Finance systems act as a centralized repository for financial data, ensuring that sensitive information is securely stored and accessed only by authorized personnel. By implementing robust security measures and access controls, ERP Finance systems help in safeguarding sensitive financial information from potential breaches or misuse.

Customization and Scalability

Customizing ERP Finance systems to meet specific business requirements is crucial for maximizing efficiency and effectiveness. Businesses often have unique processes, workflows, and reporting needs that may not be fully addressed by standard ERP modules. Customization allows companies to tailor the system to their exact specifications, ensuring seamless integration with existing operations and optimal performance.

Customization of ERP Finance Systems

- Customizing user interfaces and dashboards to match the company’s branding and user preferences.

- Adding or modifying modules to accommodate industry-specific requirements or unique business processes.

- Integrating third-party applications or tools to enhance functionality and streamline operations.

- Developing custom reports and analytics to provide real-time insights and support data-driven decision-making.

Scalability of ERP Finance Systems

ERP Finance systems are designed to scale alongside businesses as they grow and evolve. Scalability refers to the system’s ability to handle increased data volume, user activity, and transaction throughput without compromising performance or reliability. A scalable ERP solution can accommodate business expansion, new subsidiaries, and changing regulatory requirements without the need for a complete system overhaul.

- Scalable infrastructure that can adapt to fluctuating workloads and resource demands.

- Flexible configuration options to support incremental growth and additional functionalities.

- Multi-tenant architecture for accommodating multiple entities or business units within a single system.

- Integration capabilities for connecting with external systems, partners, and vendors as the business ecosystem expands.

Last Point

As we conclude our exploration of ERP finance, it becomes evident that the integration of technology and finance is paramount for sustainable growth and success. From security measures to customization options, ERP finance offers a plethora of benefits that pave the way for a prosperous future in the financial realm.

Question Bank

How can ERP Finance benefit businesses?

ERP Finance systems streamline financial processes, enhance decision-making, and improve overall efficiency in managing finances.

What are the key features of ERP Finance systems?

Key features include financial reporting and analysis, budgeting and forecasting capabilities, and data security measures.

What challenges do organizations face during ERP Finance integration?

Organizations may encounter challenges related to data migration, system compatibility, and user training during ERP Finance integration.

How can ERP Finance systems be customized to meet specific business requirements?

ERP Finance systems offer customization options that allow businesses to tailor the software to their unique financial needs and processes.

What role does ERP Finance play in safeguarding sensitive financial information?

ERP Finance systems play a crucial role in ensuring data security and compliance with financial regulations to safeguard sensitive financial information.